Togo First

Togo: President Gnassingbé Poised to Mediate DRC-Rwanda Peace Talks

Togolese President Faure Gnassingbé is poised to take on a critical role as the African Union’s (AU) new mediator in the ongoing conflict between the Democratic Republic of Congo (DRC) and Rwanda. The nomination, proposed by Angolan President João Lourenço, was endorsed by the AU Assembly's Bureau during a virtual meeting on April 5, 2025.

Lourenço, who recently stepped down as mediator to focus on his broader AU responsibilities, suggested Gnassingbé for the role after receiving his positive response. The appointment awaits formal validation by the AU Assembly of Heads of State and Government.

Support from Lomé

Togo’s Foreign Minister Robert Dussey quickly expressed gratitude for the nomination. “We thank the Bureau of the Assembly of the African Union, and in particular President Lourenço of Angola, for his proposal, and confirm the readiness of President Faure Gnassingbé to work for peace, reconciliatio,n and stability in the east of the DRC,” he said via X (formerly Twitter).

Togo’s latest diplomatic mission solidifies its status as a key player in West African geopolitics. As regional alliances shift and tensions mount, Lomé is emerging as a hub for diplomacy and strategy, building on its leadership during the Sahel crisis and ECOWAS withdrawals.

This stance could yield tangible benefits in bilateral cooperation and border security for the country, but it poses a significant challenge in the volatile context of tensions between Rwanda and the DRC, where Qatar's discreet mediation efforts are gaining traction.

This article was initially published in French by Ayi Renaud Dossavi

Edited in English by Ange Jason Quenum

WAMU Securities: Togo Seeks CFA20 Billion in First Issue of Q2

Togo’s first issue on the West African Monetary Union (WAMU) market this quarter is scheduled for April 11. Lomé will seek CFA20 billion by issuing fungible treasury bills (Bons Assimilables du Trésor in French).

In detail, the BAT will have a face value of CFA1 million and maturities of 182 days and 364 days with varying interest rates. Proceeds will finance the country’s 2025 budget, which totals CFA2,397 billion.

Throughout the current quarter, Lomé plans to launch five issues on the regional market, eyeing CFA 75 billion. In the previous quarter, Lomé secured CFA121.5 billion from the WAMU market, out of CFA332 billion targeted for the year.

This article was initially published in French by Esaie Edoh

Edited in English by Ola Schad Akinocho

Togo Celebrates Culture with 8th Traditional Dances Festival

Togo officially launched its eighth National Festival of Traditional Dances (FESNAD) on April 3, 2025, in Kara. Governor Adjitowou Komlan presided over the ceremony, reaffirming the country’s commitment to celebrating its rich intangible heritage.

The Ministry of Communication, Media, and Culture, through the Department for the Promotion of Arts and Culture, supports this major cultural event. This year’s theme, "Our dances, our identity, our pride," encapsulates the government’s ambition to anchor traditional choreographic practices in collective memory. The ministry emphasized the urgency of preserving these practices amidst societal, urban, and media shifts that threaten their role in Togolese society.

Governor Komlan highlighted the deeper significance of traditional dances. He stated that these dances not only serve aesthetic purposes but also strengthen community bonds, foster solidarity, and reaffirm social ties.

This year’s FESNAD includes a national competition among folklore groups from Togo’s administrative regions. Each region will select a representative during local competitions to compete in the national finals in Lomé on April 26. The final coincides with Togo’s 65th Independence Day celebrations.

Organizers aim to inspire creativity while safeguarding endangered choreographic forms. They stressed that these forms face marginalization due to cultural globalization and declining community practices.

The festival serves as both a tribute to heritage and a tool for national unity. Organizers described FESNAD as a vital platform for recognizing cultural identity and fostering cohesion.

Esaïe Edoh

Lomé Airport Welcomed 1.5 Million Passengers in 2024, Up 6% YoY

Togo’s Gnassingbé Eyadema International Airport (AIGE) welcomed 1,506,946 passengers in 2024. Disclosed under the Ministry of Economy and Finance's budget execution report, the figure is 6.2% higher than in 2023, when the facility welcomed 1.4 million travelers. It is higher than the government’s forecast for 2025, 1.5 million passengers.

The growth is fueled by expanded air networks, particularly by Asky Airlines. In July 2024, Asky added flights between Lomé and Abidjan (Côte d’Ivoire) and reopened its Pointe-Noire (Congo) route in October. Six new routes were launched in 2023—two by Ethiopian Airlines and four by Asky Airlines.

Ethiopian’s direct Lomé-Washington route, introduced in June 2022, continues to drive traffic. Liz Aviation, founded by Burkinabe businessman Mahamadou Bonkoungou, also contributed with domestic and regional flights connecting Lomé to Ouagadougou.

Togo’s authorities aim to leverage this momentum by expanding AIGE’s capacity to handle two million passengers annually. Planned upgrades include enlarging waiting areas with 500 additional seats to improve passenger flow and expanding the terminal southward to enhance security measures in line with international standards. A new hotel for transit passengers is also slated for construction to solidify Lomé’s role as a regional air hub.

This article was initially published in French by Esaïe Edoh

Edited in English by Ola Schad Akinocho

Banking: Why Are Togolese Lenders Accumulating Reserves

In a regional context marked by subtle monetary tensions, Togolese banks are adopting a cautious approach. As of February 2025, they have accumulated bank reserves of CFA164.9 billion, significantly exceeding the regulatory requirement of CFA66.7 billion. This surplus, amounting to CFA98.2 billion, represents a reserve ratio of 2.47—among the highest in the West African Economic and Monetary Union (WAEMU). The figures were produced by the Union’s Central Bank, the BCEAO.

Protecting Margins and Balance Sheets

The trend spread across the region, with countries like Côte d'Ivoire and Benin having a reserve ratio of 3.46 and 1.82. Niger was the only the country in deficit, with a reserve ratio of 0.94.

This defensive strategy is driven by the anticipation of a more constrained financial environment. Since the BCEAO's return to variable-rate auctions in February 2023, access to liquidity has become less fluid and more costly.

Officially, the BCEAO’s key rate remains at 3.5%, but banks are borrowing at a ceiling rate of 5.5% from the Central Bank, while the one-week interbank rate exceeds 6%. In response, banks prefer to build excess reserves rather than risk refinancing tensions.

Hoarded Liquidity, Not Immobility

Stricter prudential requirements, including a doubled minimum share capital requirement for banks since December 2023, have also prompted banks to strengthen their capital base. Despite this caution, Togolese banks continue to finance the economy, albeit with discretion. In 2024, new bank loans increased by 10% to CFAF 645 billion, reflecting a buoyant economic context with real GDP growth estimated at 5.3%. Banks are opting for controlled growth to preserve portfolio quality in an uncertain cycle.

This article was initially published in French by Fiacre E. Kakpo

Edited in English by Ola Schad Akinocho

Togo: Djamila Karim Launches New Network Promoting Women's Inclusion in Science and Technology

In Togo, a bold initiative is reshaping the tech landscape for women. Togolaises In Science (TIS), a business club focused on empowering women in Science, Technology, Engineering, Mathematics (STEM), officially launched at the Onomo Hotel on March 29, 2025. The network seeks to close the gender gap in science and technology while showcasing female expertise in Togo and its diaspora.

Djamila Kerim founded TIS, which already boasts over 100 members, including researchers, engineers, actuaries, cybersecurity experts, and entrepreneurs. These women are determined to challenge stereotypes. The club plans to serve as a hub for exchange, mentoring, and training, aiming to establish a network of 100 mentors by the end of 2025. By 2030, TIS intends to train 1,000 women in digital skills and boost Togolese women’s representation in STEM by 20%.

The launch event featured a panel discussion addressing barriers that hinder inspiring future generations. As the first chapter of the pan-African Africaines In Tech initiative, TIS relies on partnerships with businesses, NGOs, and institutions to drive its mission forward.

March’s focus on women’s rights in Togo set the stage for this launch. Activities throughout the month celebrated progress in gender equality and emphasized advancing women’s roles in science and technology.

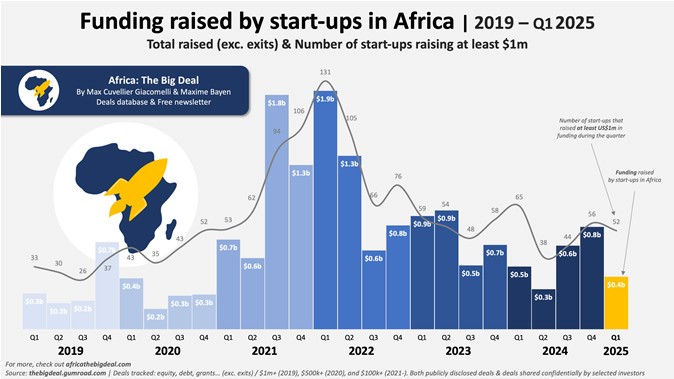

Gozem Pushes Togo into Africa’s Top 5 for Startup Financing in Q1 2025

Togo is breaking into Africa's elite technology hubs for investors as 2025 begins. The platform Africa: The Big Deal ranks the West African nation among the top five African countries where startups secured the most funding.

Gozem, a Togo-based scale-up specializing in mobility and financial services, drove this achievement with a $30 million fundraising effort.

Togo's rise stands out amid a continent-wide funding slowdown. African start-ups raised just $460 million in Q1 2025, down from $486 million in the same period last year. Gozem alone captured 6.5% of Africa’s total funding volume. Its February 2025 fundraising, backed by MSC Group and Al Mada Ventures, aims to fuel its expansion across French-speaking Africa.

This success places Togo alongside African powerhouses like Nigeria, Kenya, South Africa, and Egypt in Q1’s rankings.

Ayi Renaud Dossavi

Togo: New Business Registrations Dip 5% in Q1 2025, YoY

During the first three months of this year, 4,262 new businesses were registered at Togo’s Center for Business Formalities (Centre de Formalités des Entreprises–CFE). Year-on-year, the figure is down by 5%.

Nationals led the charge, accounting for 81% of new business start-ups. Women played a significant role, making up 28.6% of these new ventures.

January was the busiest month for business start-ups, with 1,498 new entities emerging. This was followed by 1,314 in February and 1,450 in March.

The dynamism is the fruit of various reforms implemented over the past decade to streamline business formalities and foster registration.

Coming quarters will determine whether the 5% decrease marks a structural slowdown or just a cyclical downturn. For perspective, 14,921 businesses were registered in Togo throughout 2024. More than 10% of them were registered in January.

Global AI Summit on Africa: President Gnassingbé Attended

President Faure Gnassingbé of Togo attended the Global AI Summit on Africa in Kigali, Rwanda. The two-day summit, held on April 3 and 4, convenes political leaders, tech experts, and investors to discuss Africa’s role in the artificial intelligence (AI) economy.

The event’s theme was Artificial Intelligence and Africa's Demographic Dividend. It was co-organized by the Centre for the Fourth Industrial Revolution and the World Economic Forum (WEF). Discussions focused on how AI can transform employment, data governance, and entrepreneurship across the continent.

Togo’s participation signals its intent to leverage AI as a transformative tool. “The presence of the Head of State in Kigali reflects Togo's strong commitment to anticipating the future and fully integrating artificial intelligence into an inclusive, responsible approach geared towards youth employment,” the Togolese Ministry of Finance stated.

The country has already launched projects like Novissi, a pandemic-era program that used data to distribute targeted aid. Other initiatives include Data Lab, House of AI, and a national AI strategy nearing completion.

These efforts align with Togo’s ambition to become a sub-regional digital hub by fostering innovation and growing its digital economy.

Trade: Trump Imposes 10% Customs Duty on Togolese Exports

On April 2, 2025, U.S. President Donald Trump announced a new wave of customs duties targeting imports from several African countries, including Togo. Togo will face a basic tariff of 10% on all its exports, effective on April 5, 2025.

This measure will particularly impact Togo's agricultural exports, such as coffee, cocoa, shea butter, and soya beans, which are crucial under the African Growth and Opportunity Act (AGOA). The increased tariffs could slow the growth of Togolese exports to the U.S. market, which have risen significantly from $20 million in 2021 to over $90 million in 2023 and $97 million in 2024, according to UN data.

Togo's textile industry, which recently began shipping garments to the U.S. from the Plateforme Industrielle d'Adétikopé (PIA), is also likely to be affected.

While Togo faces a 10% tariff, Lesotho is hit with a 50% rate, making it the worst-affected country on the continent.

This announcement comes as the future of AGOA remains uncertain, with its expiration set for September 2025. African countries are pushing for a 10-year extension, but Trump's tariffs could complicate this effort.

In response, Togo might strengthen ties with China, which has abolished customs duties on 98% of products from Togo and eight other African countries (Central African Republic, Chad, Djibouti, Eritrea, Guinea, Mozambique, Rwanda, and Sudan) since September 2022.

This article was initially published in French by Esaïe Edoh

Edited in English by Ange Jason Quenum