Togo’s pension fund, CNSS, invests significantly in Togolese banks

(Togo First) - While its shares in real property and other important projects are well known, the National Social Security Fund also has stakes in the banking sector. Among others, the institution headed by Ingrid Awadé has invested some of its massive surplus in Orabank and Oragroup, Ecobank, BIA, or African Lease (both the subsidiary and the group).

The National Social Security Fund (CNSS) does not only manage social contributions; it is also an important investor, both in the local real estate and banking sectors.

It has minor stakes in two of the country’s largest banks, by market shares: Orabank Togo and Ecobank Togo

.

.

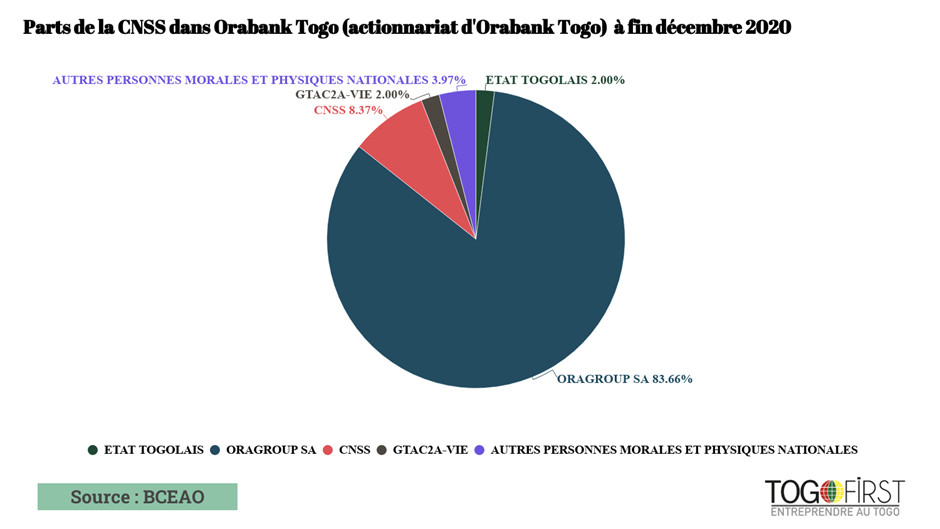

According to the latest available data (dating from December 2020) obtained by Togo First, the Fund has an 8.37% stake in Orabank Togo, and 5.25% in Ecobank Togo, the country’s second-biggest bank.

The CNSS also holds 8.2% of BIA, the subsidiary of the Moroccan group Attijariwafa.

Besides traditional banks, the state-controlled private-public utility company also invests in new financial entities. It holds respectively 32.5% and 8% of African Lease Group (ALG) and its subsidiary African Lease Togo which specializes in leasing, factoring, and bonding.

As mentioned above, the pension fund also invests in real estate, notably the Renaissance Residence project. It invested CFA17 billion in the Saint Pérégrin hospital (under construction) and is one of the shareholders of the Société Nouvelle de Boissons (SNB), a new brewer. Through Kifema Capital, an investment vehicle steered by Togo Invest, the CNSS holds shares in the Kekeli Efficient Power plant.

Togo is not the only country in the region to have a pension fund with diversified investments. In Niger, Burkina Faso, and Benin also, pension funds invest in various financial institutions.

Ayi Renaud Dossavi